| ☐ | Preliminary Proxy Statement |

| ☐ |

|

| ☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material under §240.14a-12 |

| ☒ | No fee required |

| ☐ | Fee paid previously with preliminary materials |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and0-11 |

|

399 PARK AVENUE

4TH FLOOR

NEW YORK, NEW YORK 10022

| Notice of Annual Meeting of Stockholders | |

April 20, 2022

Dear Stockholder,

We cordially invite you to attend our 2022 Annual Meeting of Stockholders, to be held on Thursday, June 2, 2022 at 8:30 a.m. (Eastern Time) at the offices of Moelis & Company located at 399 Park Avenue, 4th Floor, New York, NY 10022.

The Notice of Annual Meeting of Stockholders and the Proxy Statement that follow describe the business to be conducted at the meeting.

Your vote is important. We encourage you to vote by proxy in advance of the meeting, whether or not you plan to attend the meeting.

Sincerely,

Kenneth Moelis

Chair and Chief Executive Officer

399 PARK AVENUE

4TH FLOOR

NEW YORK, NEW YORK 10022

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

| ||

We are holding our 2022 annual meeting2024 Annual Meeting of stockholdersStockholders (the “Annual Meeting”) for the following purposes, which are described in more detail in the Proxy Statement:

2024 Annual Meeting of Stockholders | Meeting Date | Thursday, June 6, 2024 | ||

Time | 8:30 a.m. (Eastern Time) | |||

Place | Offices of Moelis & Company 399 Park Avenue, New York, NY 10022 |

| 1. | to elect five directors to our Board of Directors; |

| 2. | to approve, on an advisory basis, the compensation of our |

| 3. | to approve, on an advisory basis, the frequency (every one, two or three years) of future advisory votes to approve the compensation of our Named Executive Officers; |

| 4. | to approve the 2024 Moelis Omnibus Incentive Plan; |

| 5. | to ratify the appointment of Deloitte & Touche LLP (“Deloitte”) as our independent registered public accounting firm for the fiscal year ending December 31, |

| 6. | to transact any other business as may properly come before the meeting or any adjournment or postponement thereof. |

Only stockholders of record as of the close of business on April 7, 202210, 2024 will be entitled to attend and vote at the Annual Meeting.

As permitted by the rules of the Securities and Exchange Commission (the “SEC”), we are sending our stockholders a Notice of Internet Availability of Proxy Materials (the “Notice”) rather than a paper set of the proxy materials. The Notice includes instructions on how to access our proxy materials over the internet, as well as how to request the materials in paper form.

Your vote is important. We encourage you to vote by proxy in advance of the meeting, whether or not you plan to attend the meeting. The Notice includes instructions on how to vote, including by internet and telephone. If you hold your shares through a brokerage firm, bank, broker-dealer or other similar organization, please follow their instructions.

We intend to hold the Annual Meeting in person. We continue to monitor the protocols that federal, state and local governments may recommend or require in light of the evolving coronavirus (COVID-19) pandemic. The health and well-being of our team members and our stockholders are paramount. As a result, we may impose additional procedures or limitations on meeting attendees (beyond those described herein) or may decide to hold the meeting in a virtual-only format over the Internet. Any such changes regarding the Annual Meeting will be announced in a press release and filing with the SEC.

By order of the Board of Directors,

Osamu Watanabe

General Counsel and Secretary

April 20, 202224, 2024

| ||

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY

MATERIALS FOR THE ANNUAL MEETING TO BE HELD ON JUNE 2, 2022.6, 2024.

The Company’s Proxy Statement and 20212023 Annual Report on Form 10-K

are also available at www.proxyvote.com.

| Letter from our Chair and CEO | |

TABLE OF CONTENTSDear Stockholders:

We cordially invite you to attend our 2024 Annual Meeting of Stockholders, to be held on June 6, 2024, at the offices of Moelis & Company located at 399 Park Avenue, 4th Floor, New York, NY 10022. The Notice of Annual Meeting of Stockholders and the Proxy Statement that follow describe Moelis & Company’s achievements, compensation highlights and governance practices to be discussed at the meeting.

At this year’s Annual Meeting we are seeking your vote on several items, including the election of our directors, approval of our 2024 Omnibus Plan, and our executive compensation practices. Your vote matters, and your support will continue to allow us to position our Firm for long-term success. We encourage you to vote by proxy in advance of the meeting, whether or not you plan to attend.

Below I reflect on our 2023 activity and results, and provide my thoughts on how we have positioned ourselves for 2024 and beyond. We look forward to your participation at the Annual Meeting.

Challenging markets and differentiated advice

2023 was a difficult year for global markets and for our business. The lingering headwinds of rapidly rising interest rates, inflation and geopolitical instability brought continued disruption and dampened transactional activity throughout the year. While our conversations with clients were at some of the highest levels we have seen since our founding, many of these discussions were forward-looking in nature, preparing our clients to transact when economic uncertainty moderates and financing conditions improve.

In this environment more than ever, our innovation and creativity, global connectivity, and deep client relationships were important differentiators for our Firm. The seamless integration of our business across sectors, products and regions enabled us to be nimble and quickly pivot to support our clients. In many instances, this involved bringing together our industry and product coverage teams to adapt creative hybrid capital solutions for our clients and their evolving business needs. This meaningful collaboration elevated the quality of our advice and execution on over $300 billion of transactions for our clients and resulted in adjusted full year revenues of $860 million for our Firm.

Our capital-light business model allowed us to return $224 million to our shareholders in 2023, with $177 million in dividends and $47 million in share repurchases(1). Since our IPO in 2014, we have paid $32.45 in dividends per share to our shareholders, representing approximately 130% of our IPO price(2). We remain debt-free with a fortress balance sheet, which continues to provide a strong foundation and significant flexibility for pursuing compelling market opportunities when they arise.

Disciplined investment and future growth

Throughout my career, I have chosen to invest in talent during periods of market dislocation, which has proven to generate significant value and been fundamental to building and scaling our Firm. 2023 was no exception as we took advantage of the unique market opportunity to invest strategically, hiring 24 Managing Directors while also actively managing our total employee headcount, which grew just under 5%. Our new Managing Directors strengthen our capabilities across the largest industry fee pools and enhance our regional and product expertise.

| (1) | Includes dividend paid in Q1 2024 with respect to Q4 2023 performance. Share repurchases primarily consists of shares repurchased from employees for the purpose of settling tax liabilities incurred upon delivery of equity-based compensation and share buybacks pursuant to the Company’s share repurchase program. |

| (2) | IPO price of $25 per share on April 15, 2014. |

1

Letter from our Chair and CEO | ||

We significantly expanded our Technology franchise with the addition of 11 Managing Directors, allowing us to deepen and diversify our global capabilities not only in technology but across several sectors given the far-reaching implications of the industry. We also added senior expertise across the Industrials, Power & Utilities and Sports sectors, expanded our client coverage in France, and increased our capabilities in M&A, Capital Structure Advisory and Capital Markets.

With the global energy ecosystem undergoing major consolidation and change, we also focused on expanding our Energy franchise. In late 2023, we launched a dedicated Clean Technology effort to support our clients’ decarbonization and energy transition objectives. In early 2024, we scaled our energy coverage further, bringing on a highly accomplished industry veteran to lead this important franchise, and two additional senior bankers to enhance our upstream and midstream oil and gas coverage.

As we continue to grow, we remain steadfast in our commitment to develop best-in-class talent and create an environment where our team members can thrive. In 2023, we announced eight Managing Director promotions, and we elevated another seven in early 2024. Many of this year’s promotes began their careers at Moelis, which makes me particularly proud as I reflect on the culture we have built together.

Execution and client focus

Looking forward, I am optimistic about a recovery and the active transaction environment that will result. First, the duration of the slowdown and total decline in activity indicate we are closer to the end of the cycle than the beginning. As I have noted previously, history repeatedly points to robust periods of activity after slowdowns, including the dramatic bounce backs following the dotcom bubble, global financial crisis and most recently, the Covid-19 pandemic. Second, the elimination of tail risk associated with continued interest rate hikes and more recently the probability of rate cuts in the near to mid-term will improve market sentiment and instill confidence that should unlock the pent-up deal backlog. And finally, I expect the effect of two years of significantly higher interest rates will continue to prompt the need for creative alternative capital sources and solutions.

We have spent the downturn fortifying our capabilities and global network and enhancing our competitive advantage. I believe we are better positioned than ever for a resurgence in M&A. We are now focused on delivering this extensive expertise to our clients and seizing the opportunities that lie ahead.

Sincerely,

Ken Moelis

Chair & CEO

Moelis & Company

2

Table of Contents | ||||

Table of Contents

| ||||

| 3 | ||||

| 5 | ||||

| 11 | ||||

| 11 | ||||

| 15 | ||||

| 17 | ||||

Board of Directors Role in Risk Oversight and Succession Planning | 19 | |||

Board of Directors Role in Environmental, Social and Governance Matters Oversight | ||||

| 31 | ||||

Potential Payments upon Termination of Employment or Change in Control | ||||

Table of Contents | ||

Although we refer to our website in this Proxy Statement, the contents of our website are not included or incorporated by reference into this Proxy Statement. All references to our website in this Proxy Statement are intended to be inactive textual references only.

4

| Proxy Statement Highlights | |

PROXY STATEMENT HIGHLIGHTS2024 Annual Meeting of Stockholders to be held on June 6, 2024

2022 ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON JUNE 2, 2022

This section highlights certain information that you should consider before voting on the matters presented at this year’s Annual Meeting of Stockholders to be held on Thursday, June 2, 20226, 2024 at 8:30 a.m. (Eastern Time) at the offices of Moelis & Company, 399 Park Avenue, New York, NY 10022 (the “Annual Meeting”). You should read this entire Proxy Statement carefully before voting. Your vote is important. We encourage you to vote by proxy in advance of the Annual Meeting, whether or not you plan to attend the Annual Meeting. Additional information about our Annual Meeting, including details about how to participate in our Annual Meeting and how to cast your votes, is provided under “General Information” beginning on page 5.82.

2022 Annual Meeting of Stockholders

| ||

Matters to be Voted on at our 2022 Annual Meeting

| ||||

|

|

| ||

| ||||

| ||||

| ||||

Performance Highlights and Executive Compensation

Our compensation program is designed to align the interests of our named executive officers and other employees with the long-term interests of the Firm and its shareholders. The overall performance of the Company is a significant factor in determining our named executive officer compensation.

Our 2021 performance was exceptionally strong. We saw substantial growth in revenue, profitability, and returns to our shareholders on both an absolute and relative basis.

| ||

|

| |

|

| |

|

| |

| ||

| ||

Strong Growth in Revenue and Our Firm

|

We continued to exhibit strong internal talent development by promoting eight banker Managing Directors in early 2021 and 16 in early 2022 ; nearly 50% of all Managing Directors are internal promotes.

Extraordinary Profitability

|

Our Adjusted pre-tax margin of 34% in the current year led the public independent boutique investment banks.

We maintained a strong cash position and no debt.

|

|

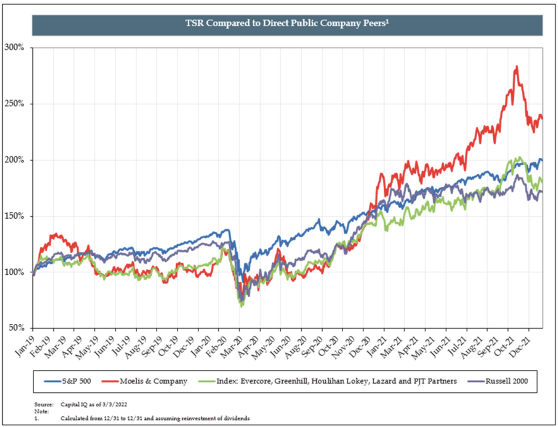

Excellent Shareholder Returns

In total, for the 2021 performance year, we returned approximately $575 million in capital to shareholders through dividends and a record level of share repurchases.

|

|

|

|

Shareholder Alignment

The following provides highlights of our 2021 compensation program, which seeks to align the interests of our named executive officers with the long–term interests of the Firm and its shareholders.

|

|

|

|

|

|

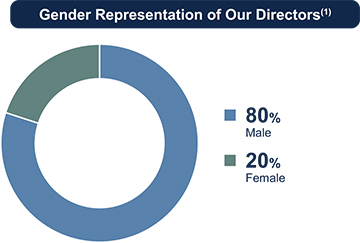

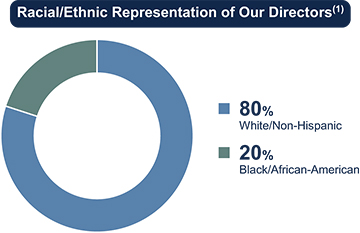

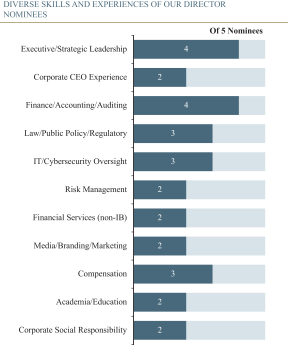

Our Board of Directors

Our Board is comprised of directors with diverse skills, experiences and backgrounds, which contribute to the Board’s ability to effectively oversee the Company and execute on its long-term strategy. In determining that each director should be nominated for re-election, our Board considered his or her service, business experience, prior directorships, qualifications, attributes and skills described in the biographies set forth below under “Proposal 1: Election of Directors—Directors.”

| ||

|

| |

|

| |

|

| |

|

| |

|

| |

| ||

Corporate Governance

We are committed to corporate governance that serves the best interests of our Company and shareholders and encourages active engagement with our shareholders. The following are our highlights of our key board and governance practices and policies.

|

We have a majority independent board

All committees of our Board are comprised entirely of independent directors

|

Combined Chair/CEO providing focused strategic leadership

Lead Independent Director with active role and responsibilities

|

Diverse qualifications, skills and experiences

Overall attendance by our directors at board and committee meetings averaged over 95% in 2021

|

Commenced a process to add an additional independent director that would provide the Board with additional experience and a diverse set of knowledge and skills that will be complimentary to our existing board members

|

Independent directors meet regularly with CEO and without management

|

Director nominees must receive a majority of the votes cast (for and against) in an uncontested election

See “General Information—What vote is required for each proposal?” on page 6 for more information

|

The Board and each committee conduct an annual self-assessment, which is overseen by the Nominating and Corporate Governance Committee.

Corporate Responsibility

Our core values of trust, partnership and commitment to long-term relationships allow us to deliver differentiated advice to our clients, attract and develop exceptional talent and maintain a diverse, innovative and agile culture. Please see “Corporate Governance–Corporate Responsibility” for more information on our commitment to our values.

Diversity & Inclusion. We are dedicated to maintaining an inclusive workplace that promotes and values diversity. As a global firm, we are committed to building a workforce with diversity of thought and perspective that are representative of the range of clients we advise around the world.

Sustainability Report. We look forward to releasing our inaugural Corporate Responsibility and Sustainability report this year, which details key Company focus areas in pursuit of our environmental, social and governance strategy.

Moelis & Company is making this Proxy Statement available to its stockholders on or about April 20, 2022 in connection with the solicitation of proxies by the Board of Directors for our Annual Meeting. As a stockholder, you are invited to attend the Annual Meeting and are entitled and encouraged to vote on the proposals described in this Proxy Statement. On or about April 20, 2022, we mailed our stockholders a Notice of Internet Availability of Proxy Materials containing instructions on how to access our Proxy Statement and our 2021 Annual Report on Form 10-K.

Moelis intends to hold the Annual Meeting in person. Moelis continues to monitor the protocols that federal, state and local governments may recommend or require in light of the evolving COVID-19 pandemic. The health and well-being of Moelis team members and Moelis stockholders are paramount. As a result, Moelis may impose additional procedures or limitations on meeting attendees (beyond those described herein) or may decide to hold the meeting in a virtual-only format over the Internet. Any such changes regarding the Annual Meeting will be announced in a press release and filing with the Securities Exchange Commission (the “SEC”).

We are a leading global independent investment bank that provides innovative strategic and financial advice to a diverse client base, including corporations, governments and financial sponsors.

Moelis & Company is a holding company and its only assets are its partnership interests in Moelis & Company Group LP (“Group LP”), its equity interest in the sole general partner of Group LP, Moelis & Company Group GP LLC (“GP LLC”), and its interests in its subsidiaries. Moelis & Company operates and controls all of the business and affairs of Group LP and its operating entity subsidiaries indirectly through its equity interest in GP LLC.

In this Proxy Statement, unless the context requires otherwise, the words “Company,” “Firm,” “we,” “us” and “our” refer to Moelis & Company and its subsidiaries, and for periods prior to the reorganization in connection with our initial public offering refer to the advisory business of our predecessor company, Moelis & Company Holdings LP (“Old Holdings”). In the reorganization, Old Holdings was renamed Moelis Asset Management LP. Unless the context requires otherwise, all references herein to “MAM” refer to Moelis Asset Management LP.

Moelis & Company was formed in January 2014 and completed an initial public offering of its Class A common stock in April 2014. Our Class A common stock trades on the New York Stock Exchange under the symbol “MC.”

Below are answers to common questions stockholders may have about the Proxy Materials and the Annual Meeting.

What are the Proxy Materials?

The “Proxy Materials” are this Proxy Statement and our annual report to stockholders for the fiscal year ended December 31, 2021. If you request printed versions of the Proxy Materials, you will also receive a proxy card.

Why did I receive a Notice of Internet Availability of Proxy Materials instead of a full set of materials?

Under rules adopted by the SEC, we are furnishing Proxy Materials to many of our stockholders on the internet, rather than mailing printed copies. If you received a Notice of Internet Availability of Proxy Materials by mail, you will not receive printed copies of the Proxy Materials unless you request them. Instead, the notice will instruct you how to access and review the Proxy Materials on the internet. If you would like printed copies of the Proxy Materials, please follow the instructions on the notice.

What items will be voted on at the2024 Annual Meeting and how does the Board of Directors recommend that I vote?

There are three proposals to be voted on at the Annual Meeting:Stockholders

2024 Annual Meeting of Stockholders | Meeting Date | Thursday, June 6, 2024 | ||

Time | 8:30 a.m. (Eastern Time) | |||

Place | Offices of Moelis & Company | 399 Park Avenue, New York, NY 10022 |

Matters to be Voted on at our 2024 Annual Meeting

Agenda and Board Recommendations | ||||

Proposal | Board Voting Recommendation | Page Reference | ||

• Election of the | ||||

| 11 | ||||

• Non-binding, advisory vote to approve executive compensation of our Named Executive Officers | FOR | 29 | ||

• Non-binding, advisory vote to approve, the | ||||

| 58 | ||||

| FOR | 59 | ||

• Ratification of Deloitte & Touche LLP | FOR | 80 | ||

5

| Proxy Statement Highlights | |

Performance Overview

We encourage you to read the following Performance Overview as background to this Proxy Statement. We continued to deliver exceptional advice to our clients amidst a challenging operating environment in 2023. Our amendeddebt-free balance sheet allowed us to take advantage of market dislocation to strategically position our Firm for the future.

Business environment | • Global M&A transaction completions declined 32%(1) • Global leveraged loan and high yield debt issuance declined 19%(2) | |

Disciplined growth | • Hired 24 Managing Directors in areas of key strategic importance to the Firm including Technology, Industrials, Energy, Clean Technology, Power, Capital Markets and Capital Structure Advisory. • Internally promoted eight bankers to Managing Director • Actively managed our headcount, with total headcount growth of 5% despite expansion of new Managing Director population by approximately 20%. | |

Business highlights | • Ranked #3 M&A boutique globally by volume(3) • Ranked #1 global Restructuring advisor by announced volume(4) • Winner of IFR’s America’s and EMEA Restructuring Deals of the Year (Carvana and MetroBank, respectively) |

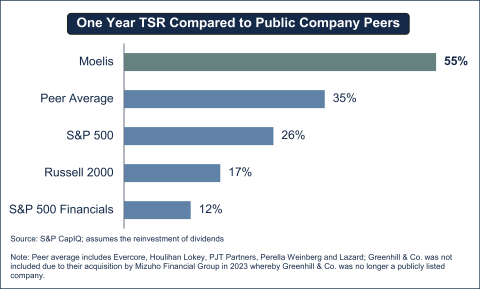

Financial performance and shareholder returns | ||||||||

Adjusted Revenues(5) $860.1 million Execution of over $300 billion of transactions for our clients despite challenging markets | Adjusted EPS(5) $(0.20) Due to slow deal environment and significant investment in senior banker talent | |||||||

1-Year TSR(6) 55% Compares to peer average of 35% | Dividends $2.40 per share Maintained declared dividends per share year over year | |||||||

| (1) | LSEG, global M&A transaction completions greater than $100 million; data obtained from LSEG on 1/30/2024 |

| (2) | LSEG; data obtained from LSEG on 1/4/2024 |

| (3) | Dealogic; Dealogic Quarterly Rankings report, Mergers & Acquisitions – Full Year 2023 |

| (4) | LSEG; excludes sovereigns, data obtained from LSEG on 1/5/2024, |

| (5) | See Annex A for a reconciliation between GAAP and Adjusted (non-GAAP) financial information |

| (6) | S&P CapIQ; data obtained from CapIQ on 3/14/2024 |

6

| Proxy Statement Highlights | |

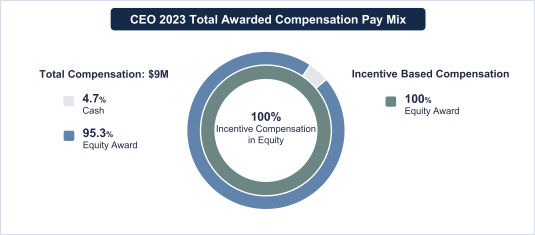

Shareholder Alignment

The following provides highlights of our 2023 compensation program, which seeks to align the interests of our named executive officers with the long–term interests of our Firm and restated by-laws require that we receive advance notice of any proposals to be brought before the Annual Meeting by our stockholders. We have not received any such proposals. We do not anticipate any other matters will come before the Annual Meeting. If any other matter properly comes before the Annual Meeting, the proxy holders appointed by our Board of Directors will have discretion to vote on those matters.

The Board of Directors recommends:its shareholders.

|

|

Multi-year sale restrictions on equity that |

Who may vote at the meeting?

Holders of Class A common stock and holders of Class B common stock as of the close of business on April 7, 2022 (the “Record Date”) may vote at the Annual Meeting.

How many shares may be voted at the Annual Meeting?

Only stockholders of record as of the close of business on the Record Date will be entitled to vote at the Annual Meeting. As of the close of business on the Record Date, there were 64,956,709 shares of Class A common stock and 4,685,898 shares of Class B common stock entitled to vote.

How many votes do I have?

Holders of our Class A common stock are entitled to one vote for each share held as of the Record Date. Holders of our Class B common stock are entitled to ten votes for each share held as of the Record Date. Holders of our Class A common stock and Class B common stock will vote as a single class on all matters at the Annual Meeting.

What vote is required for each proposal?

For the election of directors, each incumbent director must receive a majority of the votes cast (for and against) with respect to such director (meaning that the number of votes cast “for” a director’s election must exceed the number of votes cast “against” that director’s election) in an uncontested election. Pursuant to our by-laws, each incumbent director nominated for election must submit an irrevocable resignation, contingent on (i) not receiving a majority of the votes cast in an uncontested election, and (ii) the acceptance of that proffered resignation by the Board of Directors in accordance with the policies and procedures adopted by the Board of Directors for such purpose. In the event an incumbent director does not receive a majority of the votes cast in an uncontested election, the Nominating and Corporate Governance Committee of the Board of Directors will make

a recommendation to the Board of Directors whether to accept or reject such incumbent director’s resignation or whether other action should be taken. The Board of Directors, taking into account the Nominating and Corporate Governance Committee’s recommendation, will decide whether to accept or reject such incumbent director’s resignation and will publicly disclose its decision, including, if the Board of Directors determines to reject such resignation, the rationale of the decision. The Board of Directors is not required to accept the resignation of an incumbent director that fails to receive a majority of the votes cast in an election that is not a Contested Election. If the Board of Directors accepts a director’s resignation, or if a nominee for director is not elected and the nominee is not an incumbent director, then the Board of Directors may fill the resulting vacancy by vote of a majority of the Board of Directors then in office, even if less than a quorum, or by a sole remaining director, or may decrease the size of the Board of Directors in accordance with the Company’s by-laws. The foregoing is subject to the rights and obligations of the Company pursuant to the stockholders agreement between the Company, Moelis & Company Partner Holdings LP and certain stockholders. See “Certain Relationships and Related Person Transactions—Transaction with Our Directors, Executive Officers and 5% Holdings—Rights of Partner Holdings and Stockholders Agreement” below.

The approval, on an advisory basis of the compensation of our named executive officers, the ratification of the Company’s independent registered public accounting firm and any other proposals that may come before the Annual Meeting will be determined by the majority of the votes cast.

As of the Record Date, Moelis & Company Partner Holdings LP (“Partner Holdings”) owned all of our outstanding Class B shares. Partner Holdings is controlled by Kenneth Moelis, our Chair and Chief Executive Officer. As a result of his beneficial ownership of shares and control of nearly a majority of the voting power of our shares, Mr. Moelis has substantial ability to decide all matters to be voted upon at the Annual Meeting. See “Certain Relationships and Related Person Transactions—Transactions with Our Directors, Executive Officers and 5% Holders—Rights of Partner Holdings and Stockholders Agreement” below.

How are abstentions and broker non-votes counted?

Abstentions (shares present at the meeting in person or by proxy that are voted “abstain”) and broker non-votes (explained below) are counted for the purpose of establishing the presence of a quorum, but are not counted as votes cast.

What is the difference between a stockholder of record and a beneficial owner of shares held in street name?

Stockholder of Record. If your shares are registered directly in your name with our transfer agent, Computershare, you are a stockholder of record.

Beneficial Owner of Shares Held in Street Name. If your shares are held in an account at a brokerage firm, bank, broker-dealer or other similar organization, then you are a beneficial owner of shares held in “street name.” The organization holding your account is considered the stockholder of record. As a beneficial owner, you have the right to direct the organization holding your account on how to vote the shares you hold in your account.

How do stockholders of record vote?

There are four ways for stockholders of record to vote:

|

| ✓ |

|

| ✓ |

|

Hedging Prohibition. We prohibit hedging of our common stock and equity-based awards by our named executive officers and employees. |

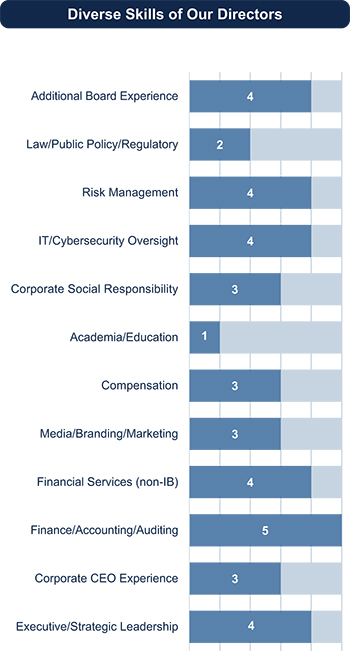

Our Board of Directors

Our Board is comprised of directors with diverse skills, experiences and backgrounds, which contribute to the Board’s ability to effectively oversee the Company and execute on its long-term strategy.

7

|

| |

How do beneficial ownersIn determining that each director should be nominated for re-election, our Board considered his or her service, business experience, prior directorships, qualifications, attributes and skills described in the biographies set forth below under “Proposal 1: Election of shares heldDirectors—Directors.”

Skills | Allison | Shropshire | Worrell | Cantor | Moelis | |||||

Executive/Strategic Leadership | ✓ | ✓ | ✓ | ✓ | ✓ | |||||

Corporate CEO Experience | ✓ | ✓ | ✓ | |||||||

Finance/Accounting/Auditing | ✓ | ✓ | ✓ | ✓ | ✓ | |||||

Financial Services (non-IB) | ✓ | ✓ | ✓ | ✓ | ||||||

Media/Branding/Marketing | ✓ | ✓ | ✓ | |||||||

Compensation | ✓ | ✓ | ✓ | |||||||

Academia/Education | ✓ | |||||||||

Corporate Social Responsibility | ✓ | ✓ | ✓ | |||||||

IT/Cybersecurity Oversight | ✓ | ✓ | ✓ | ✓ | ||||||

Risk Management | ✓ | ✓ | ✓ | ✓ | ||||||

Law/Public Policy/Regulatory | ✓ | ✓ | ||||||||

Additional Board Experience | ✓ | ✓ | ✓ | ✓ | ||||||

Corporate Governance

We are committed to corporate governance that serves the best interests of our Company and shareholders and encourages active engagement with our shareholders. The following are highlights of our key board and governance practices and policies.

| ✓ | Independent Board |

| • | We have a majority independent Board |

| • | All committees of our Board are comprised entirely of independent directors |

| ✓ | Strong Board Leadership |

| • | Combined Chair/CEO providing focused strategic leadership |

| • | Lead Independent Director with active role and responsibilities |

| • | Our non-employee directors who have served multiple years on our Board own equity of the Company representing greater than 4x the annual retainer fee. |

| ✓ | Increased Board Size |

| • | Ms. Worrell joined our Board on January 1, 2023 in line with the Board’s decision in 2022 to increase the size of the Board from five to six members with four independent directors. |

| • | Ms. Worrell brings senior executive and strategic leadership experience from a range of institutions and expertise across technology, media and business services. |

| • | Following Ms. Richardson’s decision to resign from our Board in 2023 due to professional obligations, we are engaged in a process to fill the fourth independent director seat by our next annual meeting. With the assistance of a third-party search firm, we have actively worked to add a fourth independent director to the Board. While we intended to fill the fourth seat before year-end 2023, several candidates we were pursuing were ultimately not available or viable due to conflicts that developed and became known late in the process. We continue to work with a third-party |

8

| Proxy Statement Highlights | |

search firm and remain committed to appointing a director who, based on their diversity of skills and experiences, will be a valuable asset to our Board. |

| ✓ | Qualified and Engaged Board |

| • | Diverse qualifications, skills and experiences |

| • | Overall attendance by our directors at Board and committee meetings was over 75% in 2023 |

| ✓ | Executive Sessions |

| • | Independent directors meet regularly with CEO and without management |

| ✓ | Accountability |

| • | Director nominees must receive a majority of the votes cast (for and against) in an uncontested election |

| • | See “General Information—What vote is required for each proposal?” on page 83 for more information |

| • | Directors are elected annually |

| ✓ | Annual Self-Assessments |

| ✓ | The Board and each committee conduct an annual self-assessment, which is overseen by the Nominating & Corporate Governance Committee. |

Corporate Responsibility

Our core values of trust, partnership and commitment to long-term relationships allow us to deliver differentiated advice to our clients, attract and develop exceptional talent and maintain a diverse, inclusive, innovative and agile culture. Please see “Corporate Governance–Corporate Responsibility” for more information on our commitment to our values.

Diversity & Inclusion. We are dedicated to maintaining an inclusive workplace that promotes and values diversity. As a global firm, we are committed to building a workforce with diversity of thought and perspective that is representative of the range of clients we advise around the world.

Sustainability Report. In 2023, we renewed our Sustainability report, which details key Company focus areas in street name vote?pursuit of our environmental, social and governance strategy.

If you hold your shares through a brokerage firm, bank, broker-dealer or other similar organization, please follow their instructions.Proposal to Approve the 2024 Moelis Omnibus Incentive Plan

Can I change my vote after submitting a proxy?

Stockholders of record may revoke their proxy before the Annual Meeting by delivering to the Company’s General Counsel and Secretary a written notice stating that a proxy is revoked, by signing and delivering a proxy bearing a later date, by voting again via the internet or by telephone or by attending and voting in personOn April 23, 2024, at the Annual Meeting.

Street name stockholders who wish to change their votes should contact the organization that holds their shares.

If I hold shares in street name through a broker, can the broker vote my shares for me?

If you hold your shares in street name and you do not vote, the broker or other organization holding your shares can vote on certain “routine” proposals but cannot vote on other proposals. Proposals 1 and 2 are not considered “routine” proposals. Proposal 3 is a “routine” proposal. If you hold shares in street name and do not vote on Proposals 1 and 2 your shares will be counted as “broker non-votes.”

Who is paying for this proxy solicitation?

The Company is paying the costsrecommendation of the solicitation of proxies. Members ofCompensation Committee, our Board of Directors and officers and employees may solicit proxiesunanimously adopted the 2024 Moelis Omnibus Incentive Plan (which we refer to in this Proxy Statement as the “2024 Plan”), subject to approval by mail, telephone, fax, email or in person. We will not pay directors, officers or employees any extra amounts for soliciting proxies. We may, upon request, reimburse brokerage firms, banks or similar entities representing street name holders for their expenses in forwarding Proxy Materials to their customers who are street name holders and obtaining their voting instructions.

The Company has engaged D.F. King & Co., Inc. (“D.F. King”) to assist in the solicitation of proxies for theour stockholders at our 2024 Annual Meeting. The Company2024 Plan will bear the entire cost of proxy solicitation, including the preparation, assembly, printing, mailing and distribution of the proxy materials, and will pay D.F. King a fee of approximately $20,000, plus reimbursement of out-of-pocket expenses. The address of D.F. King is 48 Wall Street, 22nd Floor, New York, NY 10005. You can call D.F. King at (800) 714-3312 or email at MC@dfking.com.

What do I need to do if I want to attend the meeting?

You will need to provide evidence that you are a stockholderbecome effective as of the Recorddate of our 2024 Annual Meeting (the “Effective Date”) if approved by our stockholders, and will not become effective if such approval is not received. The 2024 Plan replaces our 2014 Omnibus Incentive Plan (the “2014 Plan”), which expired by its terms on April 14, 2024.

The 2024 Plan provides for the issuance of a maximum of 15,000,000 shares plus any shares associated with awards granted under the 2014 Plan outstanding as of April 14, 2024 that are subsequently forfeited, canceled, exchanged or surrendered without distribution of shares, or settled in cash. We expect the 2024 Plan to last for two to three years, and in any event the 2024 Plan will expire by its terms on the third anniversary of the Effective Date.

Our people are our most valuable asset driving our revenue and profits. Equity compensation enhances our ability to attract, retain and incentivize talent in our highly competitive industry. Our equity compensation program is a critical tool for aligning the interests of our employees with the long-term interests of our stockholders, clients and driving long-term value creation. If the 2024 Plan is not approved by our stockholders, we will lose this critical tool for managing our business.

Our Board of Directors recommends that you vote “FOR” the 2024 Moelis Omnibus Incentive Plan.

9

| Proxy Statement Highlights | |

Highlights of the 2024 Moelis Omnibus Incentive Plan

The 2024 Moelis Omnibus Incentive Plan includes features designed to protect stockholder interests and incorporate the best practices highlighted below.

| The 2024 Moelis Omnibus Incentive Plan Design Features | ||

× No “evergreen” provision | ✓ Fixed maximum share limit | |

× No liberal share recycling | ✓ Limited Duration | |

× No repricing (or cash buybacks) of underwater stock options or stock appreciation rights | ✓ NEO awards are subject to a clawback | |

× No “reload” equity awards | ✓ Separate annual compensation limit of $800,000 for | |

× No equity grants below fair market value (subject to certain limited exceptions) | ✓ Double Trigger Change in Control Provisions | |

The Importance of the 2024 Plan and Reasons to Vote for the Proposal

| ✓ | Necessary to retain top talent in our human-capital intensive business. |

| ✓ | Integral to recruiting new talent in our competitive industry. |

| ✓ | Links Pay with the Long-Term Performance of the Firm. |

| ✓ | Supports our talent-based cost structure and our compensation philosophy and practices. |

Impact on our Firm if the 2024 Plan is Not Approved

A reduction in equity compensation would result in an increase in cash compensation.

We are a human-capital intensive business and our ability to pay appropriate levels of compensation in the form of equity incentives has enabled us to recruit, retain and motivate highly talented individuals dedicated to our long-term growth and success. Equity compensation is a key part of our culture, not just at senior levels but throughout our company. We believe equity-based compensation is critical for directly aligning the interests of our employees with those of our shareholders and cultivating a strong commitment by our employees to continue to drive shareholder value. It also reduces the need for cash compensation.

Important Considerations when Evaluating our 2024 Plan

It is important to compare our equity compensation practices to other publicly traded independent investment banks.

Proxy advisors compare Moelis, and our publicly traded independent investment banking peers, to a group drawn from companies within the broad “Diversified Financials” GICS sector designation. This can bedesignation includes, but is not limited to, mortgage REITs, lending and trading firms, consumer and specialized finance companies, asset managers and other less-human capital based businesses that do not share the same need for equity compensation.

Our equity compensation practices are generally comparable to other publicly traded investment banking advisory firms we have identified in this Proxy Statement (see “Executive Compensation—Framework to Determine Executive Compensation—Performance relative to Our Peers”). These peers generally employ similar equity compensation programs as a copymethod of your proxy card or a brokerage statement showing your shares. You must also bring photo identification. If you hold your shares in street nameattracting and wishretaining talent and aligning employee interests with long-term interests of stockholders. We believe it is important to vote in person at the meeting, you will needcompare our equity compensation practices to contact the organization that holds your sharesthose of our immediate publicly traded independent investment banking peers in order to obtainassess or our 2024 Plan.

For a legal proxy from that organization.

We intend to hold the annual meeting in person, we continue to monitor the protocols that federal, state and local governments may recommend or require in lightmore detailed summary of the evolving COVID-19 pandemic. The health and well-being of our team members and our stockholders are paramount. As a result, we may impose additional procedures or limitations on meeting attendees (beyond those described herein) or may decide to hold the meeting in a virtual-only format over the Internet. Any such changes regarding the Annual Meeting will be announced in a press release and filing with the SEC.

Where can I find voting results?

We will file a Current Report on Form 8-K with the SEC including the final voting results from the Annual Meeting within four business daysproposed 2024 Moelis Omnibus Incentive Plan, please see “Proposal 4: Approval of the Annual Meeting.2024 Moelis Omnibus Incentive Plan”.

10

| Proposal 1: Election of Directors | |

I share an address with another stockholder. Why did we receive only one setProposal 1: Election of Proxy Materials?Directors

Some banks, brokers and nominees may be participating in the practice of “householding” Proxy Materials. This means that only one copy of our Proxy Materials may be sent to multiple stockholders in your household. If you hold your shares in street name and want to receive separate copies of the Proxy Materials in the future, or if you are receiving multiple copies and would like to receive only one copy for your household, you should contact the bank, broker, or other nominee who holds your shares.

Upon written or oral request, the Company will promptly deliver a separate copy of the Proxy Materials to any stockholder at a shared address to which a single copy of any of those documents was delivered. To receive a separate copy of the Proxy Materials, you can contact our Investor Relations department at (212) 883-3800, investor.relations@moelis.com or 399 Park Avenue, 4th Floor, New York, NY 10022.

Who should I contact if I have additional questions?

You can contact our Investor Relations department at (212) 883-3800, investor.relations@moelis.com or at our principal executive offices at 399 Park Avenue, 4th Floor, New York, NY 10022. Stockholders who hold their shares in street name should contact the organization that holds their shares for additional information on how to vote. If you have any questions about how to vote your shares, you may contact our proxy solicitor at:

D.F. King & Co, Inc.

48 Wall Street, 22nd Floor

New York, NY 10005

Call Toll-Free: (800) 714-3312

Banks and Brokers Call: (212) 269-5550

PROPOSAL 1: ELECTION OF DIRECTORS

Our Board of Directors is currently comprised of five directors. At the Annual Meeting, stockholders will vote to elect as directors of the Company the five nominees named in this Proxy Statement. Each of the directors elected at the Annual Meeting will hold office until the 20232025 Annual Meeting of Stockholders and until his or her successor has been duly elected and qualified.

The Board of Directors has nominated Kenneth Moelis, Eric Cantor, Kenneth L. Shropshire, John A. Allison IV and Yolonda RichardsonLaila Worrell for election at the Annual Meeting. The persons named as proxies will vote to elect each of these nominees unless a stockholder indicates that his or her shares should be withheld with respect to one or more of such nominees.

The following table sets forth information regarding our directors, including their ages as of the date hereof.

Kenneth Moelis, 65 Chair of the Board of Directors and Chief Executive Officer |

| |||||||||

Kenneth Moelis | is the Founder, Chair of the Board of Directors and Chief Executive Officer | |||||||||

|

| |||||||||

|

| |||||||||

|

| |||||||||

|

|

|

| |||||

Mr. Moelis’ knowledge of and extensive experience in investment banking and the financial services industry give the Board of Directors valuable industry-specific knowledge and expertise on these and other matters. In addition, as our Founder and Chief Executive Officer, he has an unparalleled understanding of our business and operations, which positions him well to serve on our Board of Directors. | ||||||

Eric Cantor, 60 Managing Director, Vice Chair of the Company and Director | Eric Cantor has served as a Managing Director, Vice Chair of the Company, and a |

| and 113th Congresses where he led the public policy agenda for the House. During his time in office, Mr. Cantor was a leading voice on the economy, job creation and policies focused on improving the lives of the American middle class. He championed pro-growth solutions including lowering taxes, eliminating excessive regulation, strengthening businesses, and encouraging entrepreneurship. He was also regularly featured in publications focusing on a wide range of topics including both domestic and international matters. Mr. Cantor holds a B.A. from The George Washington University, a J.D. from The College of William and Mary, and an M.A. from Columbia University. | ||

| He serves as a member of the Bipartisan Policy Center’s Executive Council on Infrastructure and has been named a visiting fellow at Harvard University’s John F. Kennedy School of Government. He served on the U.S. Department of Defense Policy Board from 2017-2020. Mr. Cantor’s knowledge of public and economic policy, his extensive experience in public policy, international business and geo-politics and his investment banking experience position him well to serve on our Board of Directors. |

11

| Proposal 1: Election of Directors | |

Kenneth L. Shropshire, 69 Lead Independent Director | Kenneth L. Shropshire has been a director since July | |||

Mr. Shropshire’s knowledge of corporate and business law and his extensive experience with business law and ethics, negotiation, and dispute resolution position him well to serve on our Board of Directors. | ||||

| ||||

John A. Allison IV, 75 Independent Director | John A. Allison IV has been a director since October 2015. Mr. Allison is Executive in Residence at Wake Forest School of Business and Chairman of the Executive Advisory Council of the Cato Institute’s Center for Monetary and Financial Alternatives, and a member of the Cato Institute’s Board of Directors. Mr. Allison was president and CEO of the Cato Institute from October 2012 to April 2015. Mr. Allison served as the Chief Executive Officer of BB&T Corporation from 1989 to 2008. Mr. Allison was also a director of BB&T Corporation from 1986 to 2014, serving as Chairman from 1989 to 2008, and a Branch Bank & Trust Company director from 1986 to 2008 and 2013 to 2014. Mr. Allison served as Chairman and Chief Executive Officer of Branch Bank & Trust Company from 1989 to 2008. He also served as a Distinguished Professor of Practice on the faculty of the Wake Forest University Schools of Business from 2009 to 2012. Mr. Allison is a Phi Beta Kappa graduate of the University of North Carolina—Chapel Hill. He received his master’s degree in management from Duke University and is also a graduate of the Stonier Graduate School of Banking. | |||

Mr. Allison’s knowledge of and extensive experience with finance, banking and investments, in addition to his years of experience and expertise as a senior corporate executive and public company board member, position him well to serve on our Board of Directors. | ||||

Laila J. Worrell, 56 Independent Director |

Ms. Worrell’s senior executive and strategic leadership experience from a | |||

|

| Proposal 1: Election of Directors | |

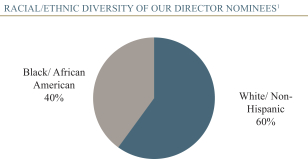

Our Board is comprised of directors with diverse skills, experiences and backgrounds, which contribute to the Board’s ability to effectively oversee the Company and execute on its long-term strategy. We are engaged in a process to fill the fourth independent director seat as further discussed in “Proxy Highlights – Corporate Governance – Increased Board Size.”

|

| |||||||||||||||

(1) The demographic information presented is based on | ||||||||||||||||

13

|

| |

Director Nomination Rights of Partner Holdings

In connection with our initial public offering, we entered into a stockholders agreement with Partner Holdings, an entity controlled by our Chair and Chief Executive Officer, Kenneth Moelis, pursuant to which our Board of Directors is required to nominate individuals designated by Partner Holdings equal to a majority of the Board of Directors, and to take allreasonable actions necessary to cause such directors to continue in office, as long as the Class B Condition is satisfied. The designees of Partner Holdings nominated by the Board of Directors for election at the Annual Meeting are Kenneth Moelis and Eric Cantor. Although the Class B Condition is satisfied, Partner Holdings has notified the Company that Partners Holdings will not designate a third nomineeany additional nominees to our Board of Directors this year. This is because the Company, which is no longer a “controlled company” under New York Stock Exchange (“NYSE”) rules, is required to satisfy NYSE independence requirements, including the requirement to have independent directors constitute a majority of our Board of Directors. In addition, in the event that a vacancy is created at any time by the death, disability, retirement, resignation or removal of any director who is designated by Holdings in accordance with the stockholders agreement, the Company agrees to take at any time and from time to time all actions necessary to cause the vacancy created thereby to be filled as promptly as practicable by a designee of Holdings, including without limitation, in the event of a resignation of a Holdings’ designee as a result of a failure to obtain a majority vote. The stockholders agreement and the Class B Condition are described under “Certain Relationships and Related Person Transactions—Transactions With Our Directors, Executive Officers and 5% Holders—Rights of Partner Holdings and Stockholders Agreement” below. Mr. Moelis’ beneficial ownership of our shares is set forth under “Stock Ownership of Certain Beneficial Owners and Management” below.

Director Nominees and Board Recommendation

In the event that any nominee for director becomes unavailable or declines to serve as a director at the time of the Annual Meeting, the persons named as proxies will vote the proxies in their discretion for any nominee who is designated by the current

board of directors to fill the vacancy. All of the nominees are currently serving as directors and we do not expect that any of the nominees will be unavailable or will decline to serve.

In determining that each director should be nominated for re-election, our Board considered his or her service, business experience, prior directorships, qualifications, attributes and skills described in the biography set forth above.

The Board of Directors recommends that you vote “FOR” each of the director nominees in this Proposal 1.

| The Board of Directors recommends that you vote “FOR” each of the director nominees in this Proposal 1 | ||

14

| Executive Officers | |

EXECUTIVE OFFICERSExecutive Officers

The following table sets forth information regarding our executive officers, including their ages as of the date hereof. Information relating to Mr. Moelis, our Chair and Chief Executive Officer, is set forth above in “Proposal 1: Election of Directors.”

Navid Mahmoodzadegan, 54 Co-President and Managing |

| ||||||

Navid Mahmoodzadegan |

| ||||||

|

| ||||||

|

| ||||||

|

| ||||||

|

|

|

He began his career as an attorney with Irell & Manella. Mr. Mahmoodzadegan serves on the Taft School Board of Trustees. Mr. Mahmoodzadegan previously served as Board Chair for the Carlthorp School Board of Trustees and served on the National Board of Directors of JumpStart. He holds an A.B. with Highest Distinction from the University of Michigan (Phi Beta Kappa) and a J.D. from Harvard Law School, magna cum laude. | |||

Co-President and Managing | Jeffrey Raich is a Co-Founder and has served as Co-President since September 2015 and as a Managing Director of our Company since 2007. Mr. Raich served as a director of our Company from April 2014 to April 2021. Prior to founding our Company, Mr. Raich worked at UBS from 2001 to 2007, where he was most recently Joint Global Head of Mergers and Acquisitions. Prior to joining UBS, Mr. Raich was a Managing Director and Head of West Coast Mergers and Acquisitions at Donaldson, Lufkin & Jenrette, where he worked from 1996 to 2000. He began his career as an investment banker with PaineWebber in 1989. He is a member of the McIntire School of Commerce Advisory Board at the University of | |||

Chief Financial Officer |

| Joseph Simon has served as our Chief Financial Officer since 2010. Prior to joining our Company, Mr. Simon served as Chief Financial Officer of Financial Security Assurance from 2002 to 2010. Prior to joining Financial Security Assurance, Mr. Simon served as Chief Financial Officer of IntraLinks and TENTV.com from 2000 to 2002. Prior to that, Mr. Simon worked at Cantor Fitzgerald where he served as Chief Financial Officer, Global Controller and Global Head of Operations from 1993 to 1999. Before joining Cantor Fitzgerald, Mr. Simon was a Fixed Income Product and Legal Entity Controller at Morgan Stanley from 1986 to 1993. He began his career at Price Waterhouse from 1983 to 1986. Mr. Simon holds a B.S. from Cornell University and an M.B.A. from The University of Michigan. He is a Certified Public Accountant. | ||

15

| Executive Officers | |

Katherine Pilcher Ciafone, 44 Chief Operating Officer | Katherine Pilcher Ciafone is a Co-Founder and has served as the Chief Operating Officer since October 2023, where she is responsible for the Firm’s global strategy and operations. Ms. Ciafone previously served as the Firm’s Chief Operating Officer of Investment Banking where she led business management and other corporate functions. Ms. Ciafone has over 20 years of experience in the investment banking industry both as a banker and as an operating executive. Prior to Moelis & Company, Ms. Ciafone worked at UBS from 2002 to 2007 in various roles, including in the office of the CEO and President of UBS Investment Bank and as an investment banker in the Financial Institutions Group. Ms. Ciafone serves on the Board of Directors of MA Financial Group Limited (ASX: MAF) and is a 2023 David Rockefeller Fellow through the Partnership for New York City. Ms. Ciafone holds a B.S. in Commerce with distinction from The McIntire School of Commerce at the University of Virginia. | |||

Osamu R. Watanabe, 63 General Counsel and Secretary | Osamu R. Watanabe has served as our General Counsel and From 1987 to 1997, Mr. Watanabe was in private practice at Sullivan & Cromwell in New York, Tokyo, Hong Kong and Melbourne. Prior to that, he clerked for the Honorable Morey L. Sear, Eastern District of Louisiana. Mr. Watanabe holds a B.A. from Antioch College and a J.D. from Yale Law School (1985). | |||

16

| Corporate Governance | |

CORPORATE GOVERNANCECorporate Governance

The Company is governed by a board of directors and various committees of the Board that meet regularly throughout the year. Our Board has three standing committees, the Audit Committee, the Compensation Committee and the Nominating and Corporate Governance Committee. Each committee has adopted and operates under a written charter. You are encouraged to visit our website at www.moelis.com to view or to obtain copies of our Corporate Governance Guidelines, committee charters and Code of Business Conduct and Ethics. Additional information relating to the corporate governance of our Company is also set forth below and included in other sections of this Proxy Statement.

Board of Directors Leadership Structure

Mr. Moelis serves as our Chair and Chief Executive Officer in accordance with the terms of his employment agreement. As Mr. Moelis is the founder, Chief Executive Officer and among the largest shareholders of the Company, we believe that combining the roles of Chair of the Board and Chief Executive Officer encourages focused, strategic leadership.

Under our Corporate Governance Guidelines, the Board of Directors does not require the separation of the offices of the Chair of the Board and the Chief Executive Officer. If at any time the Chair is not an independent director, then the Board of Directors will elect a Lead Independent Director. Our Board of Directors periodically reviews its leadership structure.

In February 2022, in consultation with our Nominating and Corporate Governance Committee, our Board of Directors voted to update our Corporate Governance Guidelines to add the role of Lead Independent Director to our Board leadership structure. Effective March 1, 2022, Ken Shropshire was elected our Lead Independent Director.Director in March, 2022. Mr. ShopshireShropshire is an independent director and active board member and also serves as the Chair of our Audit Committee.

The specific duties and responsibilities of the Lead Independent Director include the following:

Meetings and Executive Sessions

Presides at all meetings of the Board at which the Chair is not present, including executive sessions of the independent directors.

| • | Presides at all meetings of the Board at which the Chair is not present, including executive sessions of the independent directors. |

Has discretion to call meetings of the independent directors.

| • | Has discretion to call executive sessions of the independent directors. |

| • | Facilitates discussion and open dialogue among the independent directors during Board meetings, executive sessions and outside of Board meetings. |

Facilitates discussion and open dialogue among the independent directors during Board meetings, executive sessions and outside of Board meetings.

Liaison with the Chair and Management

Serves as the principal liaison between the independent directors and the Chair, without inhibiting direct communication between them.

| • | Serves as the principal liaison between the independent directors and the Chair, without inhibiting direct communication between them. |

Communicates to the Chair and management, as appropriate, any decisions reached, suggestions, views or concerns expressed by independent directors in executive sessions or outside of Board meetings.

| • | Communicates to the Chair and management, as appropriate, any decisions reached, suggestions, views or concerns expressed by independent directors in executive sessions or outside of Board meetings. |

| • | Provides the Chair with feedback and counsel concerning the Chair’s interactions with the Board. |

Provides the Chair with feedback and counsel concerning the Chair’s interactions with the Board.

| • | May communicate with management regarding any decisions reached, suggestions, views or concerns expressed by independent directors in executive sessions or outside of Board Meetings. |

Oversight of Information Provided to the Board

| • | Works with the Chair to develop and approve Board meeting agendas and meeting schedules, including to ensure that there is sufficient time for discussion of all agenda items. |

17

Works with the Chair on the appropriateness (including quality and quantity) and timeliness of the information provided to the Board.

| Corporate Governance | |

| • | Works with the Chair on the appropriateness (including quality and quantity) and timeliness of the information provided to the Board. |

Authorizes the retention of advisors and consultants who report directly to the Board when appropriate.

| • | Authorizes the retention of advisors and consultants who report directly to the Board when appropriate. |

Board and Leadership Evaluation

In consultation with the Nominating and Corporate Governance Committee, reviews and reports on the results of the Board and Committee performance self-evaluations.

| • | In consultation with the Nominating and Corporate Governance Committee, reviews and reports on the results of the Board and Committee performance self-evaluations. |

Periodically meets with independent directors to discuss Board and Committee and Chair performance, effectiveness and composition.

| • | Periodically meets with independent directors to discuss Board and Committee and Chair performance, effectiveness and composition. |

| • | Coordinate with the CEO regarding the agenda for the annual review of the CEO succession plan. |

Coordinate with the CEO regarding the agenda for the annual review of the CEO succession plan.

Stockholder Communication

| • | If requested, and in coordination with executive management, is available for consultation and direct communication with stockholders. |

If requested, and in coordination with executive management, is available for consultation and direct communication with stockholders.

Crisis Management

| • | Play an increased role in crisis management oversight, as appropriate under the circumstances. |

Play an increased role in crisis management oversight, as appropriate under the circumstances.

The Lead Independent Director shall be appointed annually and serve until his or her successor is duly appointed and qualified, or until his or her earlier removal or resignation, or such time as he or she is no longer an independent director or such time as the Chair is an independent director. Although elected annually, the Lead Independent Director is generally expected to serve for more than one year.

WithIn early 2023, we successfully added Ms. Worrell to our Board in line with our Board’s decision in 2022 to increase the growthsize of the Board from five to six members with four independent directors. Following Ms. Richardson’s decision to resign from our Company, theBoard in 2023 due to professional obligations, our Nominating and& Corporate Governance Committee has commencedis engaged in a process to add an additionalfill the fourth independent director that would provideseat. As part of the Board with additional experienceprocess, we have retained a third-party search firm to assist in identifying and assessing a diverse setslate of knowledgequalified Board candidates. See “Corporate Governance-Director Qualifications and skills that will be complimentary to our existing board members.Nominating Process” for more information.

The Board of Directors has reviewed the composition of its committees and the independence of each director and considered whether any director has a material relationship with us that could compromise his or her ability to exercise independent judgment in carrying out his or her responsibilities. The Board of Directors has determined that each of John A. Allison IV, Yolonda Richardson and Kenneth L. Shropshire and Laila Worrell is an “independent director” under applicable NYSE standards and that each such director has no relationships with the Company that would interfere with such director’s exercise of independent judgment in carrying out his responsibilities as a director of the Company.

18

| Corporate Governance | |

Dual Class Voting Structure

Mr. Moelis controls the voting power of all of our Class B common stock, which has 10:1 voting per share compared to our Class A common stock, so long as the Class B Conditions are met(1). Under the Class B Condition, which was publicly disclosed at the time of our IPO, Mr. Moelis is required to hold a substantial economic interest of approximately 4.5 million shares, which makes him one of the top stockholders of Moelis & Company and further reinforces his alignment with stockholders. Additionally, Mr. Moelis is the only person who has the right to 10 votes per Class B share and such right is not transferable(2).

We believe that the stability of our CEO role, attributable to our dual-class share structure, promotes long-term shareholder value creation in our highly competitive industry by giving us the unique ability to attract and retain high-caliber Managing Directors.

Our board is currently comprised of three independent directors who possess diverse expertise and experience and play a critical role in overseeing our company’s operations and safeguarding the interests of all of our stockholders

Board of Directors Role in Risk Oversight and Succession Planning and Environmental, Social and Governance Matters Oversight

We are exposed to a number of risks, and we regularly identify and evaluate these risks and our risk management strategy. Management is principally responsible for identifying, evaluating and managing the risks on a day-to-day basis, under the oversight of the Board and the Audit Committee. Our Managing Directors and certain business committees of our Managing Directors are responsible for various aspects of risk management

associated with our business, and our executive officers have the primary responsibility for enterprise-wide risk management. Our Chief Operating Officer, Chief Financial Officer and General Counsel work closely with our Managing Directors, our management and operations teams (including our finance and accounting, legal and compliance, human capital management and information technology and security teams) and our outsourced internal audit function to monitor and manage risk. Our executive officers meet with the Audit Committee at least four times a year in conjunction with a review of our quarterly and annual periodic SEC filings to discuss important risks we face. Our executive officers meet regularly with the Board to discuss important risks we face, including without limitation, those related to information security and coronavirus (COVID-19).security. Our Audit Committee focuses on oversight of financial risks relating to the company and the Compensation Committee determines named executive officer compensation plans and arrangements.arrangements and evaluates compensation-related risks to the Company. The full Board keeps itself regularly informed regarding risks overseen by the Audit Committee through management and committee reports and otherwise.

The Board will annually evaluateevaluates succession planning with respect to the CEO and the executive officers. In addition, the Company’s emergency succession plan is reviewed by the Board (or a committee designated by the Board) at least annually.

| (1) | Class B Condition is defined in our Amended and Restated Certificate of Incorporation filed as Exhibit 3.1 to our Form 8-K filed on April 22, 2014. |

| (2) | For a more detailed description of the Class B Condition, see “Certain Relationships and Related Person Transactions—Transactions with Our Directors, Executive Officers and 5% Holders—Rights of Partner Holdings and Stockholders Agreement”. |

19

| Corporate Governance | |

Board of Directors Role in Environmental, Social and Governance Matters Oversight

The Board will conductconducts a periodic review of matters related to environmental, social and governance (“ESG”) (other than within the purview of other committees of the Board), including the overall ESG strategy, risk oversight, including, without limitation cybersecurity risk oversight, sustainability initiatives and stakeholder engagement. The Board will also periodically reviewreviews and monitormonitors the Company’s policies and initiatives in the areas of diversity and inclusion (other than within the purview of other committees of the Board).

Our Board of Directors has the authority to appoint committees to perform certain management and administrative functions. Our Board of Directors has established an Audit Committee, Compensation Committee and Nominating and Corporate Governance Committee, each of which has the composition and the responsibilities described below. Our Board of Directors may from time to time establish other committees.

Audit Committee

Our Audit Committee oversees our accounting and financial reporting process and the audit of our financial statements and assists our Board of Directors in monitoring our financial systems and our legal and regulatory compliance.

Our Audit Committee is responsible for, among other things:

appointing, compensating and overseeing the work of our independent auditors, including resolving disagreements between management and the independent registered public accounting firm regarding financial reporting;

| • | appointing, compensating and overseeing the work of our independent auditors, including resolving disagreements between management and the independent registered public accounting firm regarding financial reporting; |

approving engagements of the independent registered public accounting firm to render any audit or permissible non-audit services;

| • | approving engagements of the independent registered public accounting firm to render any audit or permissible non-audit services; |

reviewing the qualifications and independence of the independent registered public accounting firm;

| • | reviewing the qualifications and independence of the independent registered public accounting firm; |

reviewing our financial statements and related disclosures and reviewing our critical accounting policies and practices;

| • | reviewing our financial statements and related disclosures and reviewing our critical accounting policies and practices; |

reviewing the adequacy and effectiveness of our internal control over financial reporting;

| • | reviewing the adequacy and effectiveness of our internal control over financial reporting; |

establishing procedures for the receipt, retention and treatment of accounting and auditing related complaints and concerns;

| • | establishing procedures for the receipt, retention and treatment of accounting and auditing related complaints and concerns; |

preparing the Audit Committee report required by SEC rules to be included in our annual proxy statement;

reviewing and discussing with management and the independent registered public accounting firm the results of our annual audit, our quarterly financial statements and our publicly filed reports; and

| • | preparing the Audit Committee report required by SEC rules to be included in our annual proxy statement; |

| • | reviewing and discussing with management and the independent registered public accounting firm the results of our annual audit, our quarterly financial statements and our publicly filed reports; and |

reviewing and approving in advance any proposed related person transactions.

| • | reviewing and approving in advance any proposed related person transactions. |

We believe that the functioning of our Audit Committee complies with the applicable requirements of the NYSE and SEC rules and regulations.

The members of our Audit Committee are Mr. Shropshire, Mr. Allison and Ms. Richardson and Mr. Shropshire.Worrell. Since November 2015, our Audit Committee has been comprised of three entirely independent directors as defined under NYSE rules. Mr. Allison isand Ms. Worrell are our Audit Committee financial expert,experts, as defined under SEC rules.

20

| Corporate Governance | |

Mr. Shropshire is the Chairperson of our Audit Committee.

Our Board of Directors has considered the independence and other characteristics of each member of our Audit Committee. Audit Committee members must satisfy the NYSE independence requirements and additional independence criteria set forth under Rule 10A-3 of the Exchange Act of 1934 (the “Exchange Act”). In addition, the NYSE requires that, subject to specified exceptions, including certain phase-in rules, each member of a listed company’s audit committee be independent and that audit committee members also satisfy independence criteria set forth in Rule 10A-3. In order to be considered independent for purposes of Rule 10A-3, an audit committee member may not, other than in his or her capacity as a member of the Board,board of directors, accept consulting, advisory or other fees from us or be an affiliated person of us. Our Board of Directors has determined that each of Mr. Allison, Ms. Richardson and Mr. Shropshire and Ms. Worrell qualifies as an independent director pursuant to NYSE rules and Rule 10A-3.

Our Board of Directors has adopted a written charter for the Audit Committee. The Audit Committee charterCharter is available in the Corporate Governance section of our Investor Relations website at investors.moelis.com.investors.moelis.com.

Compensation Committee

The Compensation Committee is responsible for, among other things:

reviewing and recommending policies, plans and programs relating to compensation and benefits of our directors, officers and employees;

| • | reviewing and recommending policies, plans and programs relating to compensation and benefits of our directors, officers and employees; |

reviewing and recommending compensation and the corporate goals and objectives relevant to compensation of our executive officers, including our Chief Executive Officer;

| • | reviewing and recommending compensation and the corporate goals and objectives relevant to compensation of our executive officers, including our Chief Executive Officer; |

evaluating the performance of our Chief Executive Officer and other executive officers in light of established goals and objectives and determining and approving the Chief Executive Officer’s and other executive officers compensation level based on this evaluation;

| • | evaluating the performance of our Chief Executive Officer and other executive officers in light of established goals and objectives and determining and approving the Chief Executive Officer’s and other executive officers compensation level based on this evaluation; |

administering our equity compensation plans for our employees and directors; and

| • | administering our equity compensation plans for our employees and directors; |

| • | evaluates compensation-related risks to the Company; and |

approving the appointment of a retained independent compensation consultant.

| • | approving the appointment of a retained independent compensation consultant. |

The members of our Compensation Committee are Mr. Allison, Mr. Shropshire and Ms. Richardson and Mr. Shropshire.Worrell. From February 2015, our Compensation Committee has been comprised of entirely independent directors meeting NYSE requirements. Ms. RichardsonWorrell is the Chairperson of the Compensation Committee.

As permitted under the 2014 Omnibus Incentive Plan, the Board has authorized our Chief Operating Officer and Chief Financial Officer, acting together, to grant awards of up to 2,500,000 shares in any fiscal quarter.

The Compensation Committee Charter is available in the Corporate Governance section of our Investor Relations website at investors.moelis.com.investors.moelis.com. The charter allows the Compensation Committee to form and delegate its responsibility to subcommittees of the Compensation Committee for any purpose it deems appropriate, with certain limits.

Nominating and Corporate Governance Committee

Our Nominating and Corporate Governance Committee was formed on February 23, 2021 and advises on identifying individuals qualified to become members of our Board of Directors. The Nominating and Corporate Governance Committee is responsible for, among other things:

assisting in identifying, recruiting and, if appropriate, interviewing candidates to fill positions on the Board;

| • | assisting in identifying, recruiting and, if appropriate, interviewing candidates to fill positions on the Board; |

reviewing the background and qualifications of individuals being considered as director candidates;21

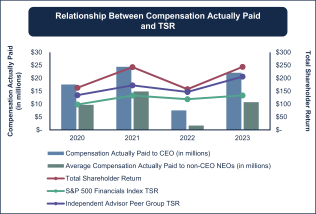

| Corporate Governance | |